Stripe Mobile App

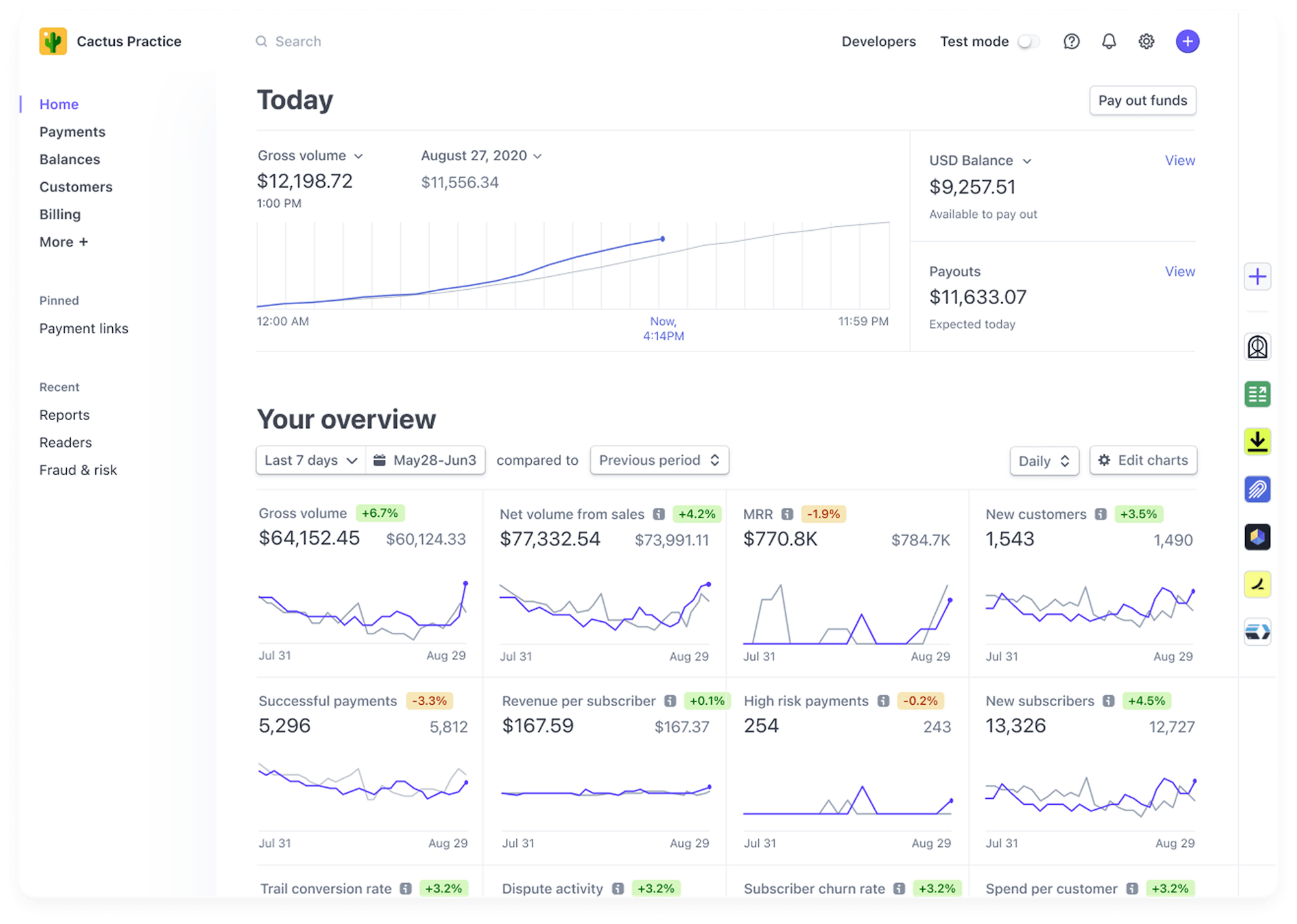

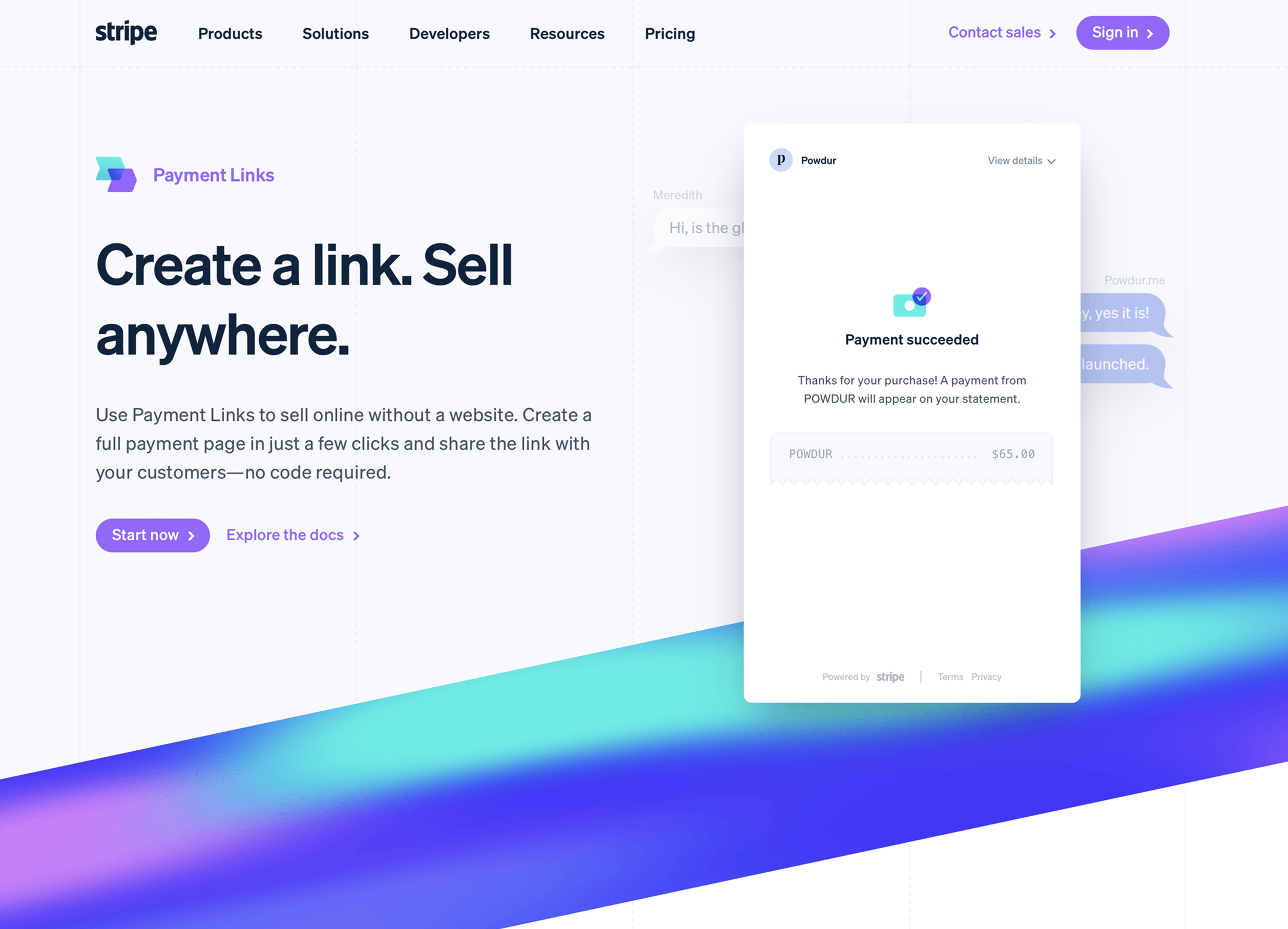

Enabling millions of merchants to run their business from their phone

Stripe's merchant experience — the set of tools that merchants use to run their business — is at the core of the company's mission to increase the GDP of the internet. And Stripe's merchants are increasingly running their entire business from their phone. From solo founders of internet-only businesses, to small businesses who collect payments using tap-to-pay, to entire fleets of salespeople who are using text messages to pitch new clients, for manay people, commerce is mobile.

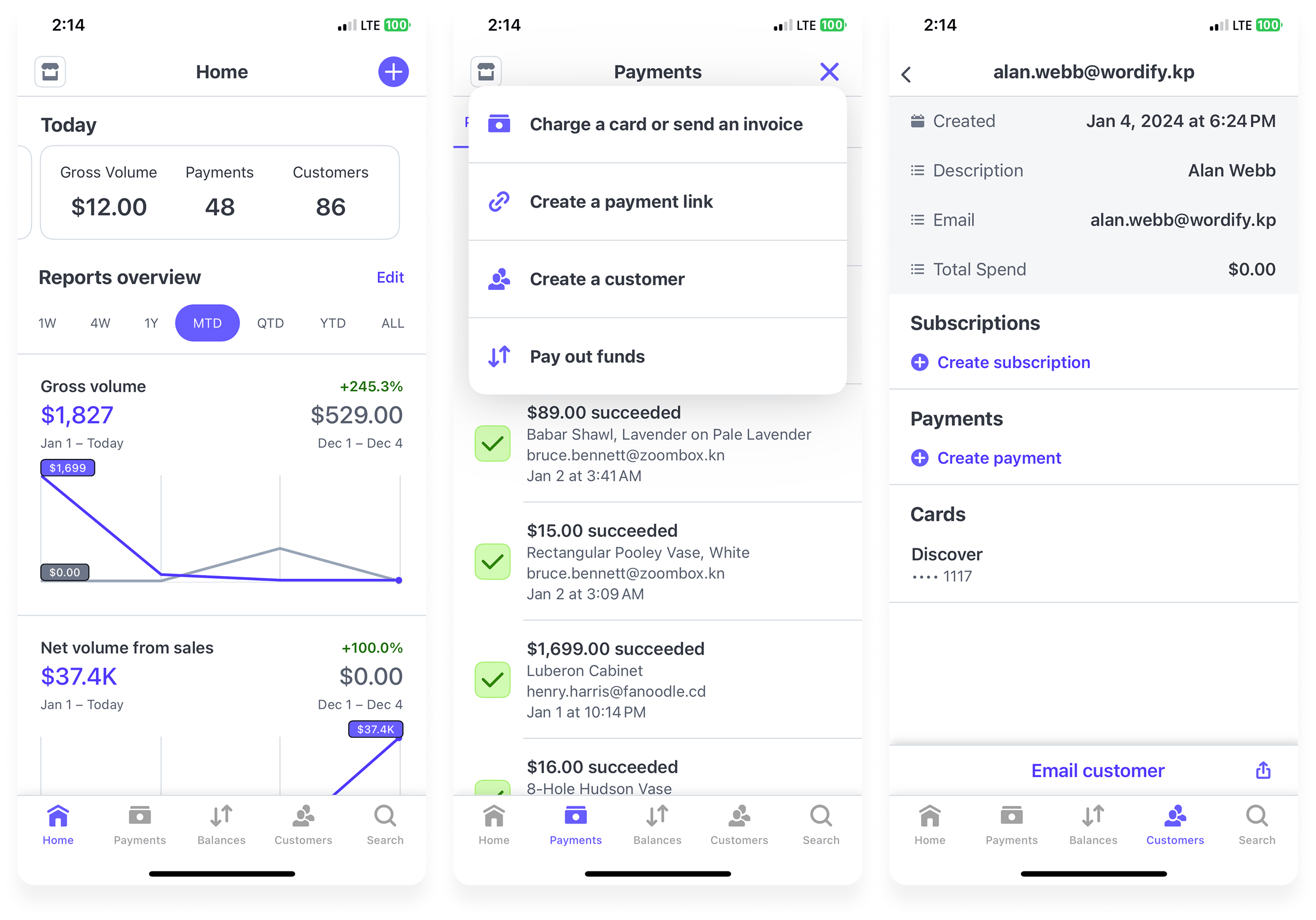

Despite this reality, in 2023, Stripe's two flagship mobile-focused products, tap to pay and payment links, were not available via Stripe's mobile app. When I joined the mobile team, we set out to change this.

Supporting features

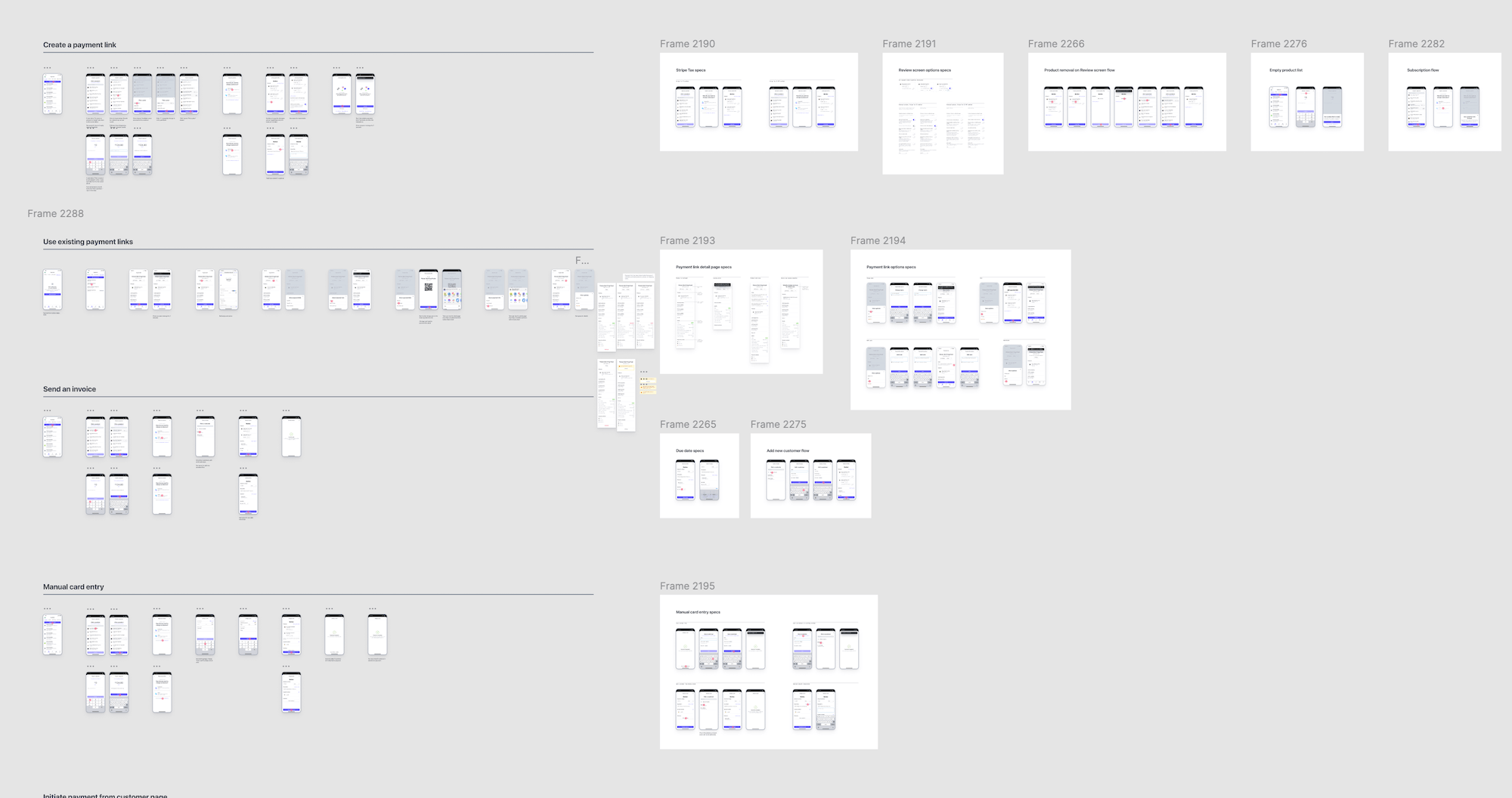

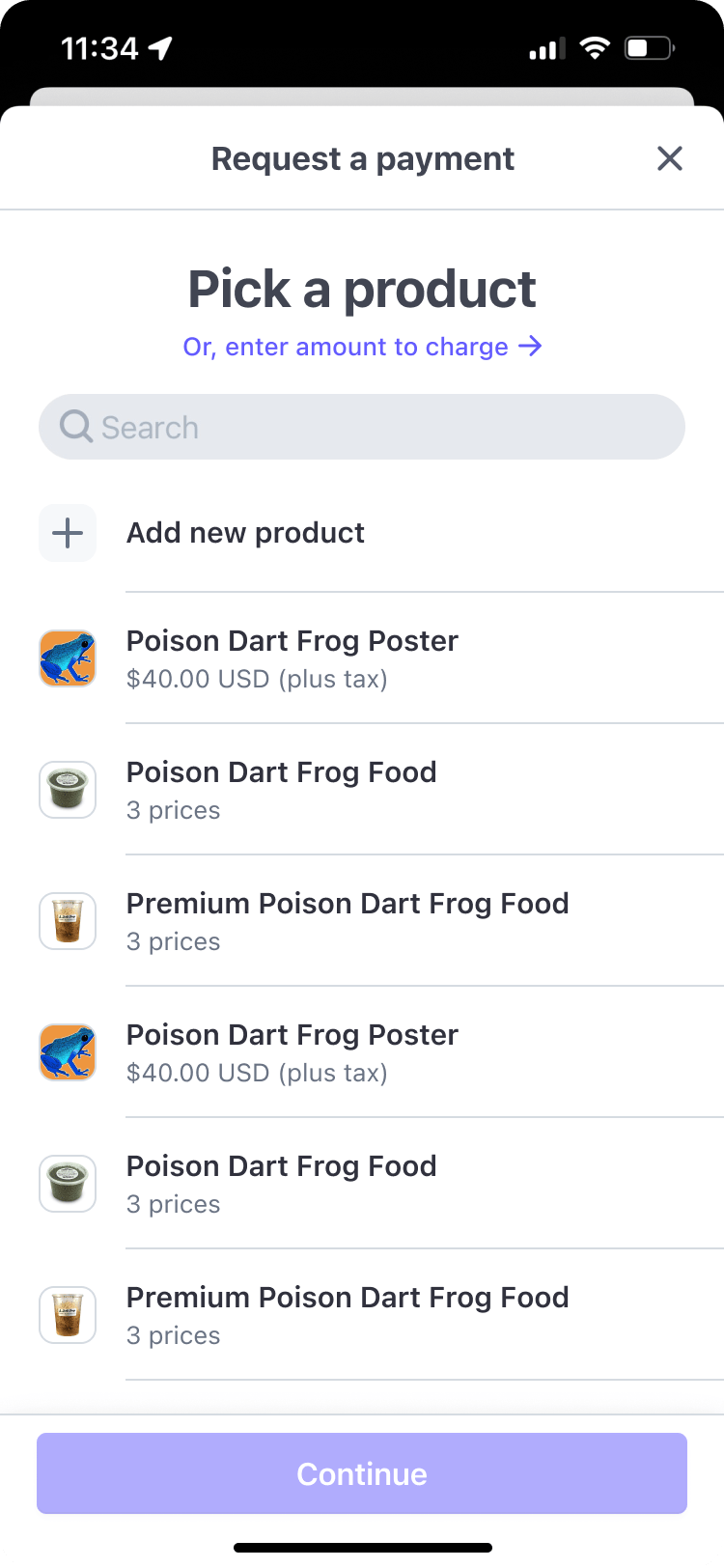

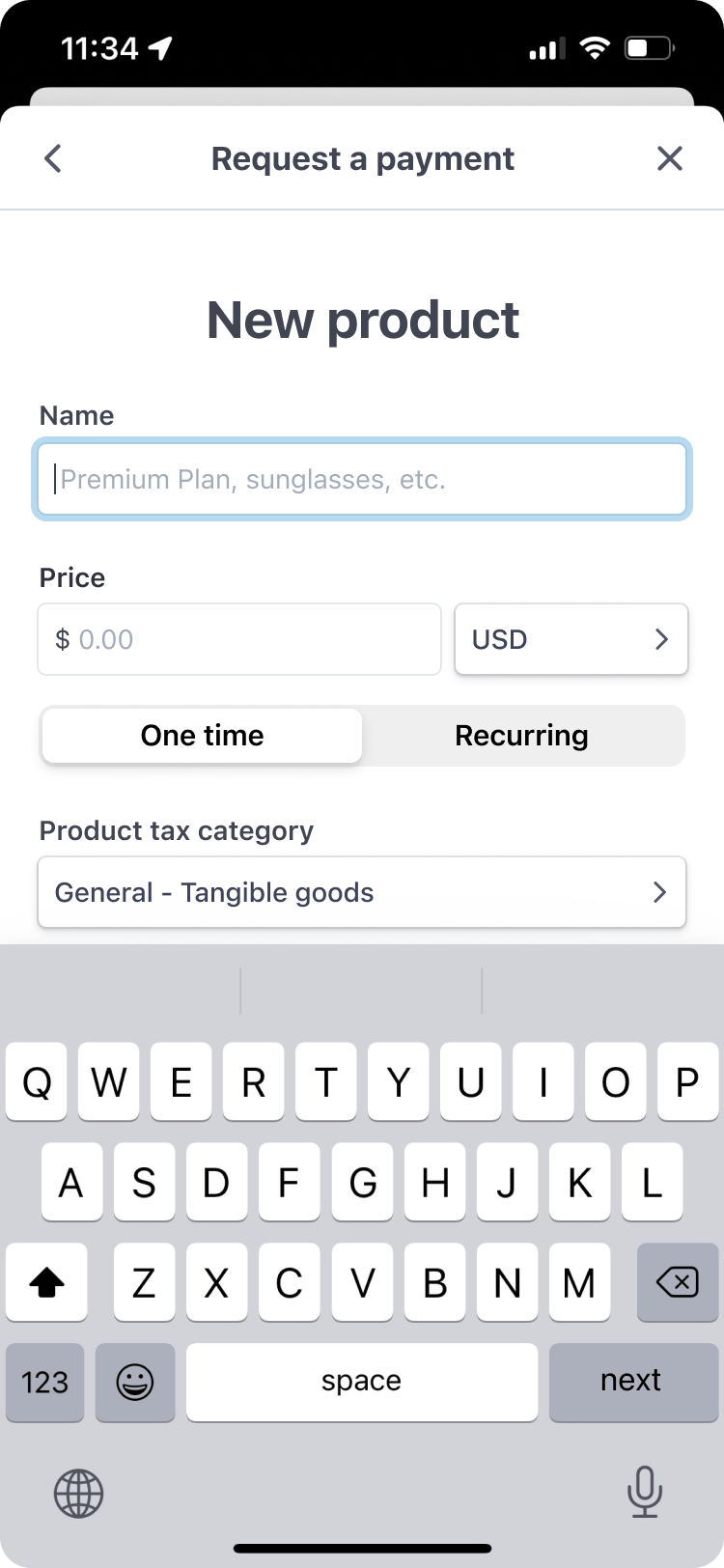

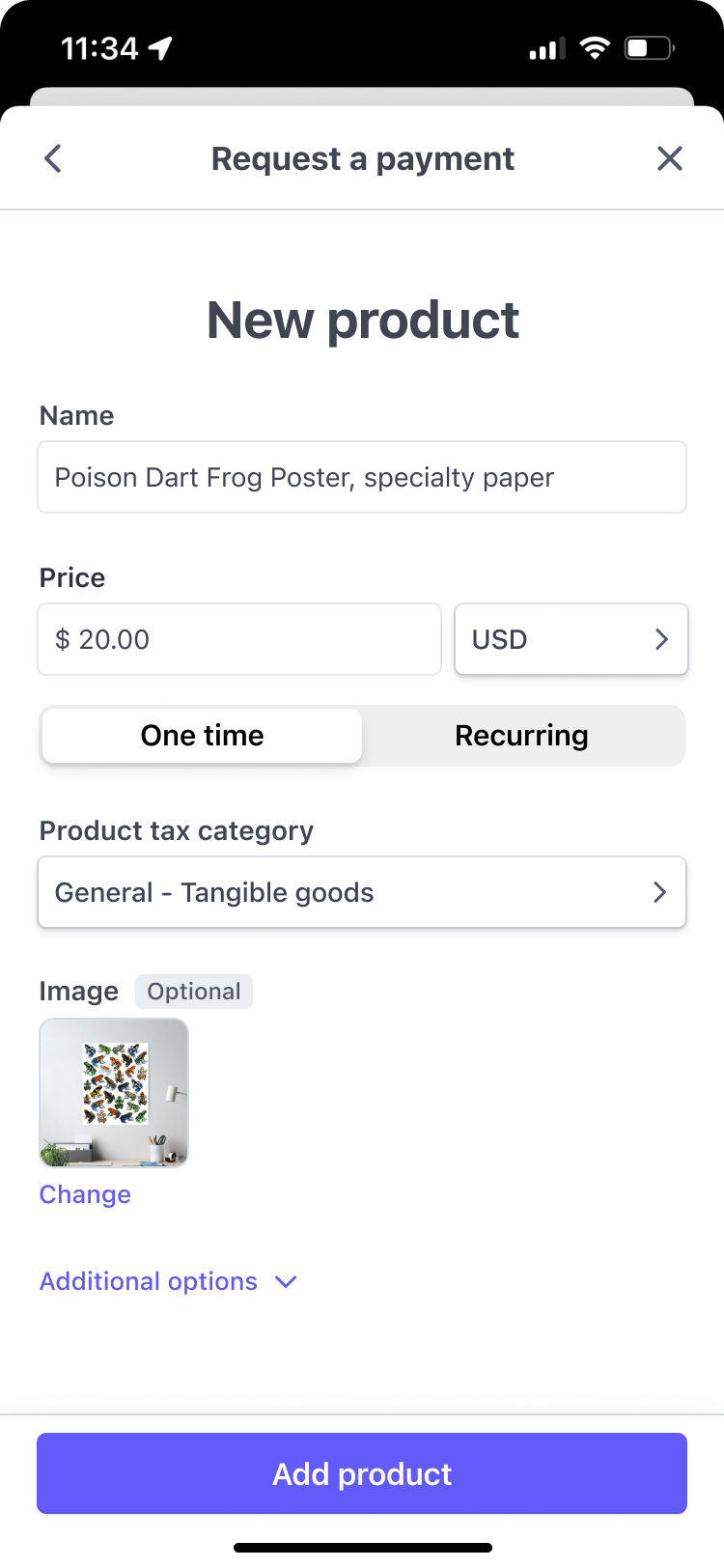

Seldom is adding a feature to an existing app as simple as a few screens; adding payment links to the Stripe app required many additional features that hadn't had a reason to exist in the app so far:

- Adding, listing, and editing products

- Creating multiple price points for a product

- Adding discounts

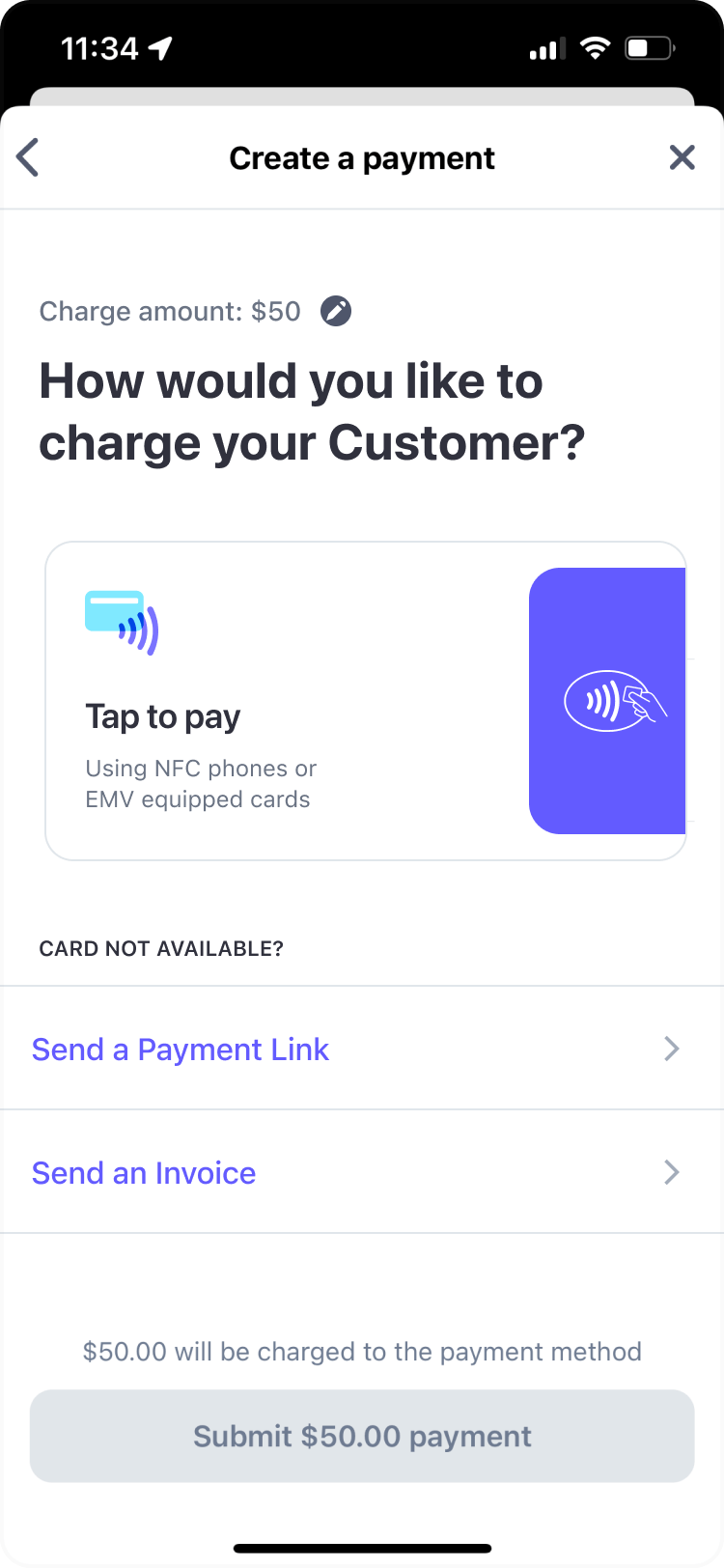

- Switching payment types during a transaction

And the list went on. The team exhaustively mapped out all the supporting features for payment links, and plotted a course to implement them leading up to the launch of payment links.

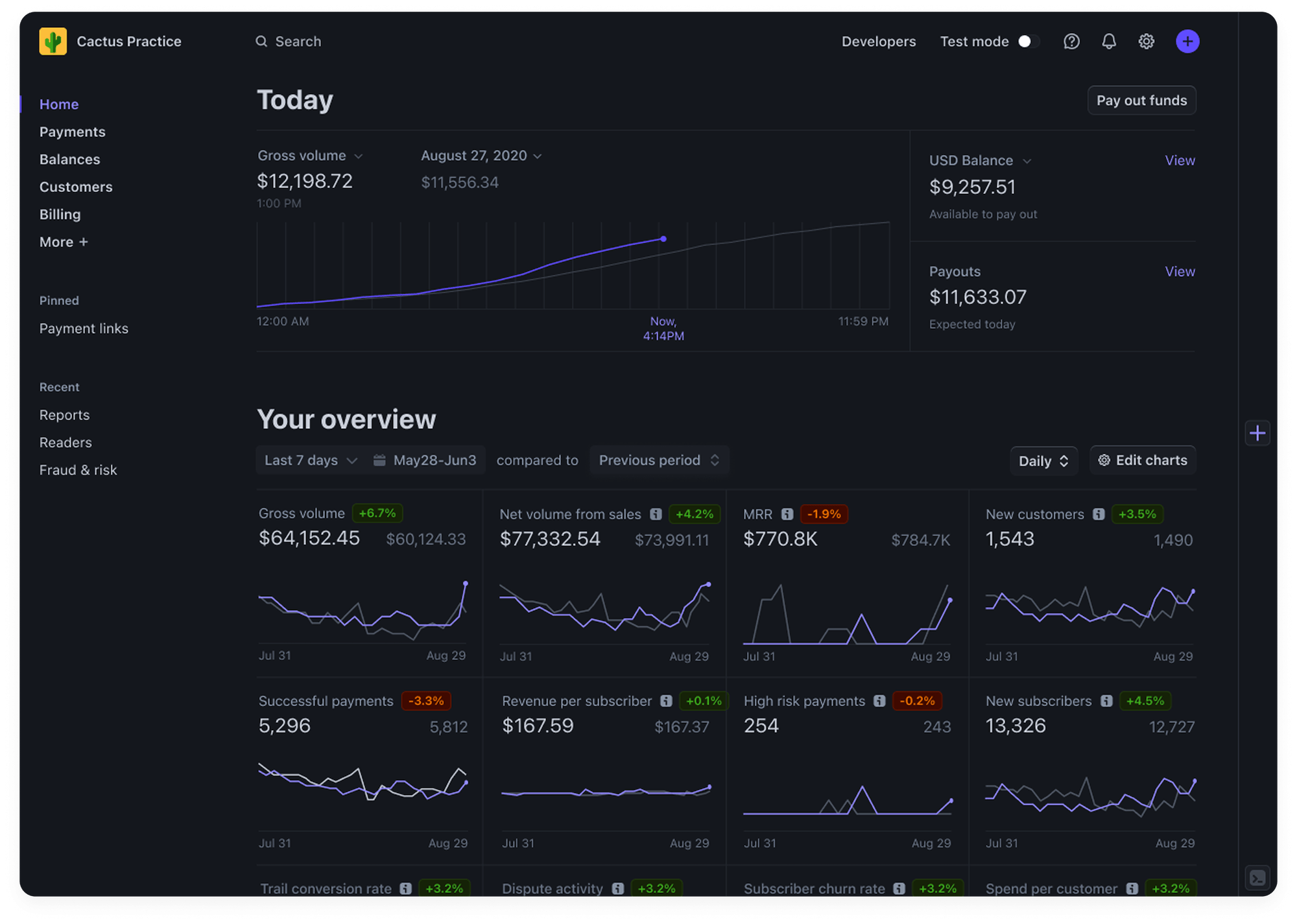

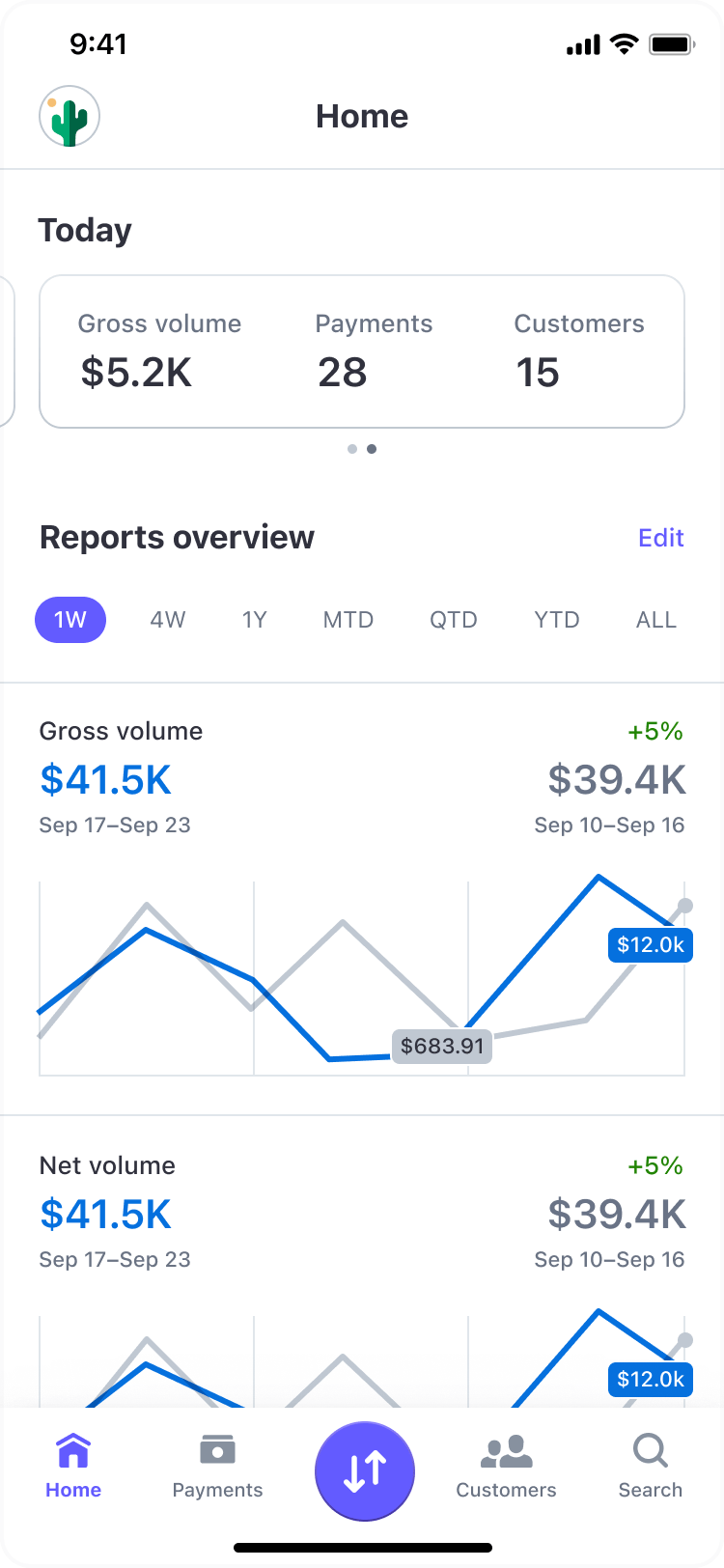

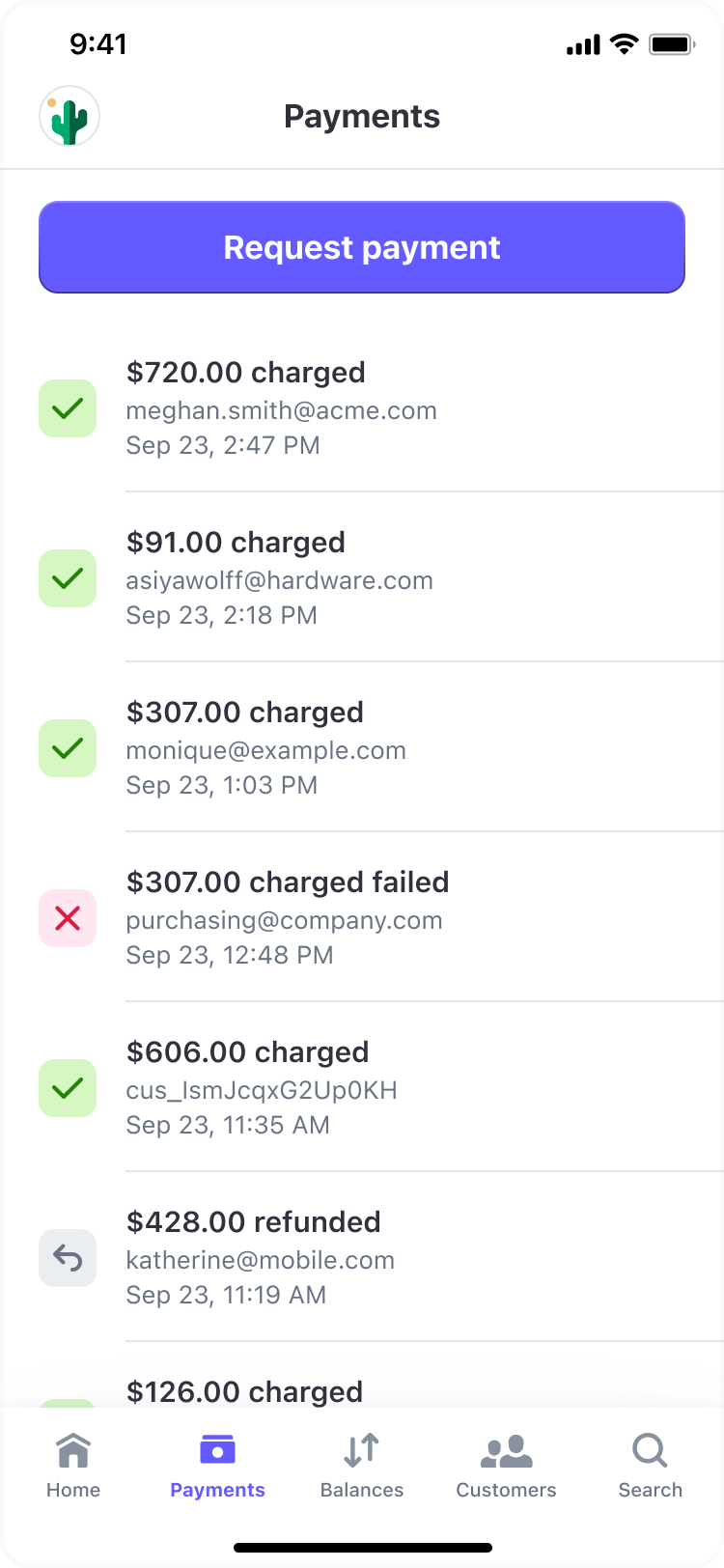

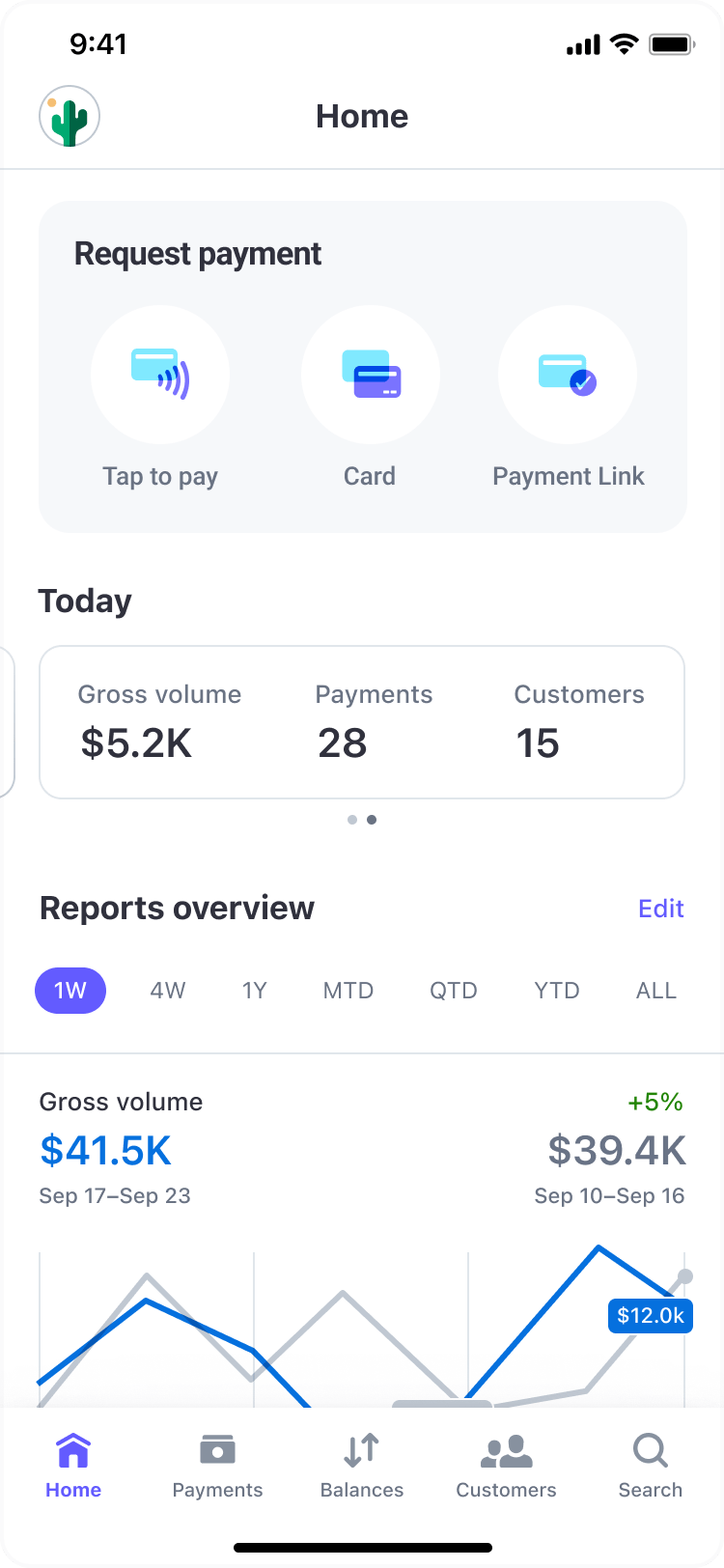

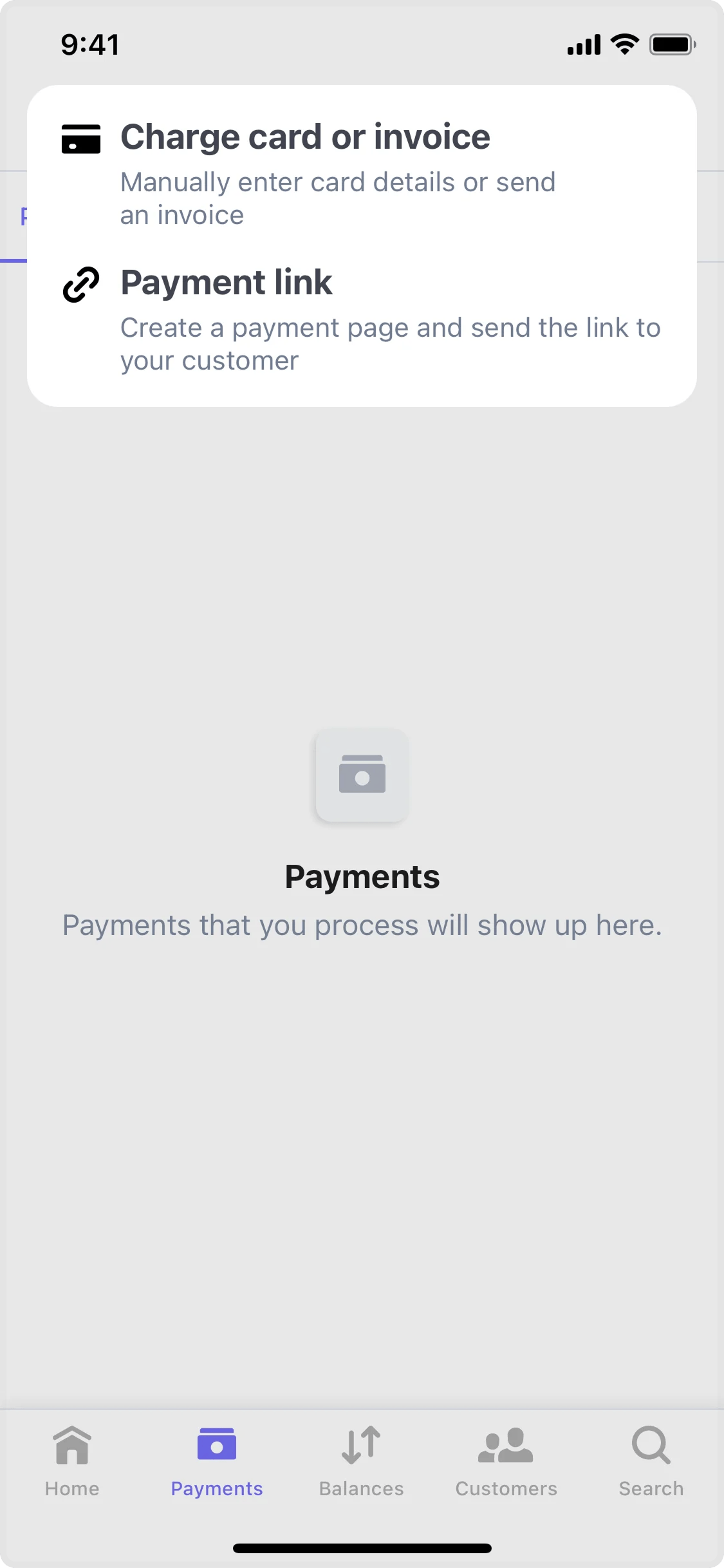

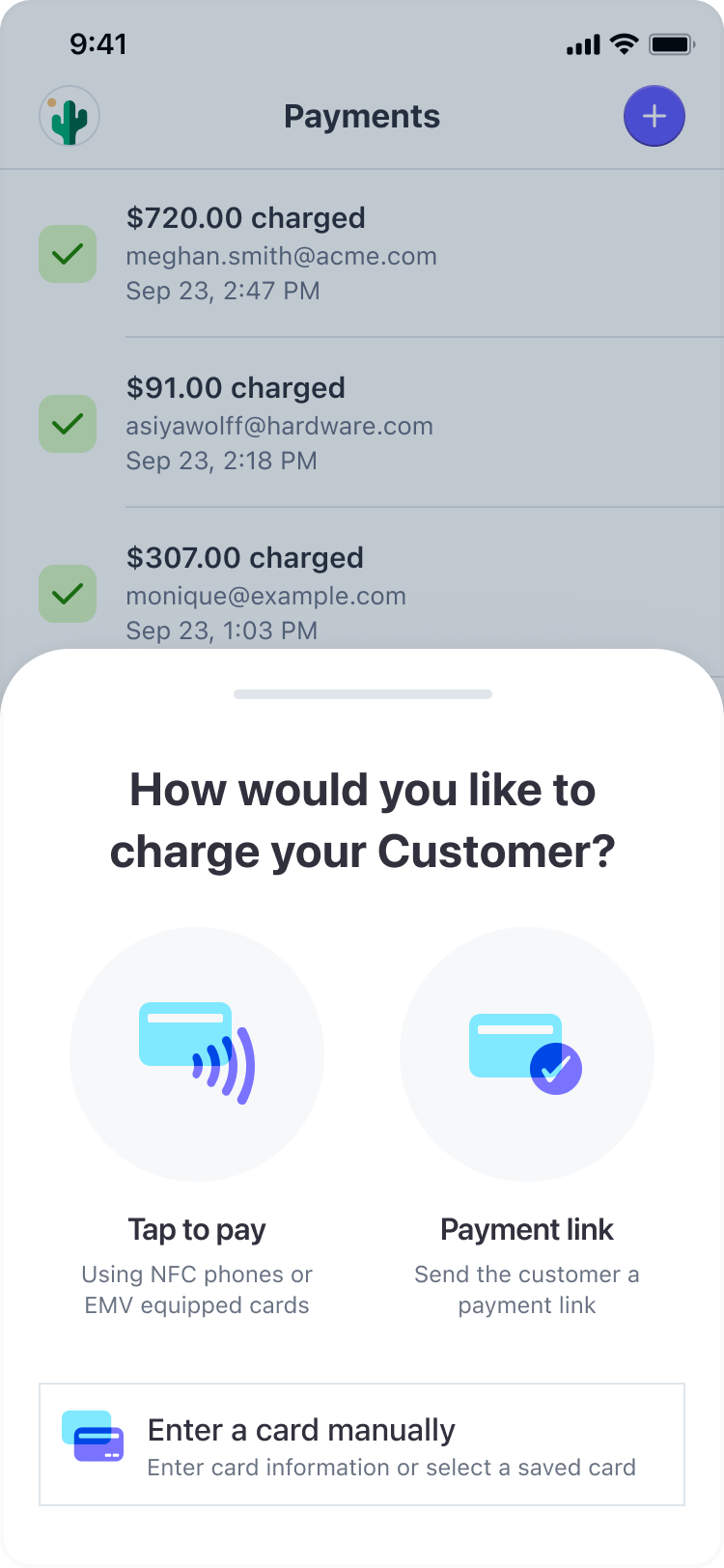

Entry points and discoverability

Another challenge when introducing new features is putting them where a user is likely to find them, but not at the expense of existing patterns and muscle memory. For payments links and tap to pay, we explored a wide number of options, from enabling users to create new payments from the tab bar, to more contextual alternatives.

Initially we chose to keep the navigation consistent with existing patterns, using a native context menu component to limit interference with existing workflows.

Tap-to-pay and payment links both reduced the likelihood of chargebacks, since they eliminate the possibility of mistyping a customer's card info. So, we designed forward-looking versions of payment flows that increased the adoption of these features.

New opportunities

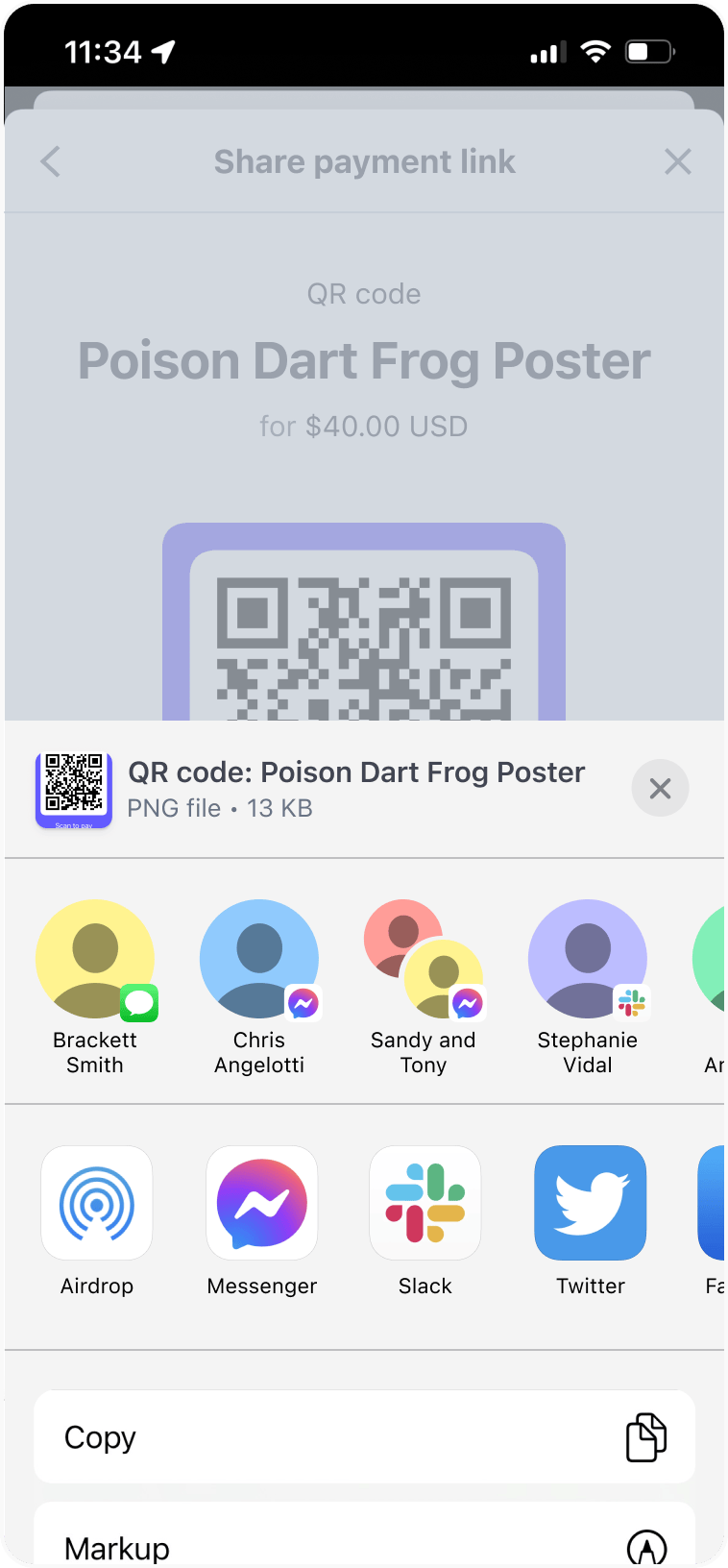

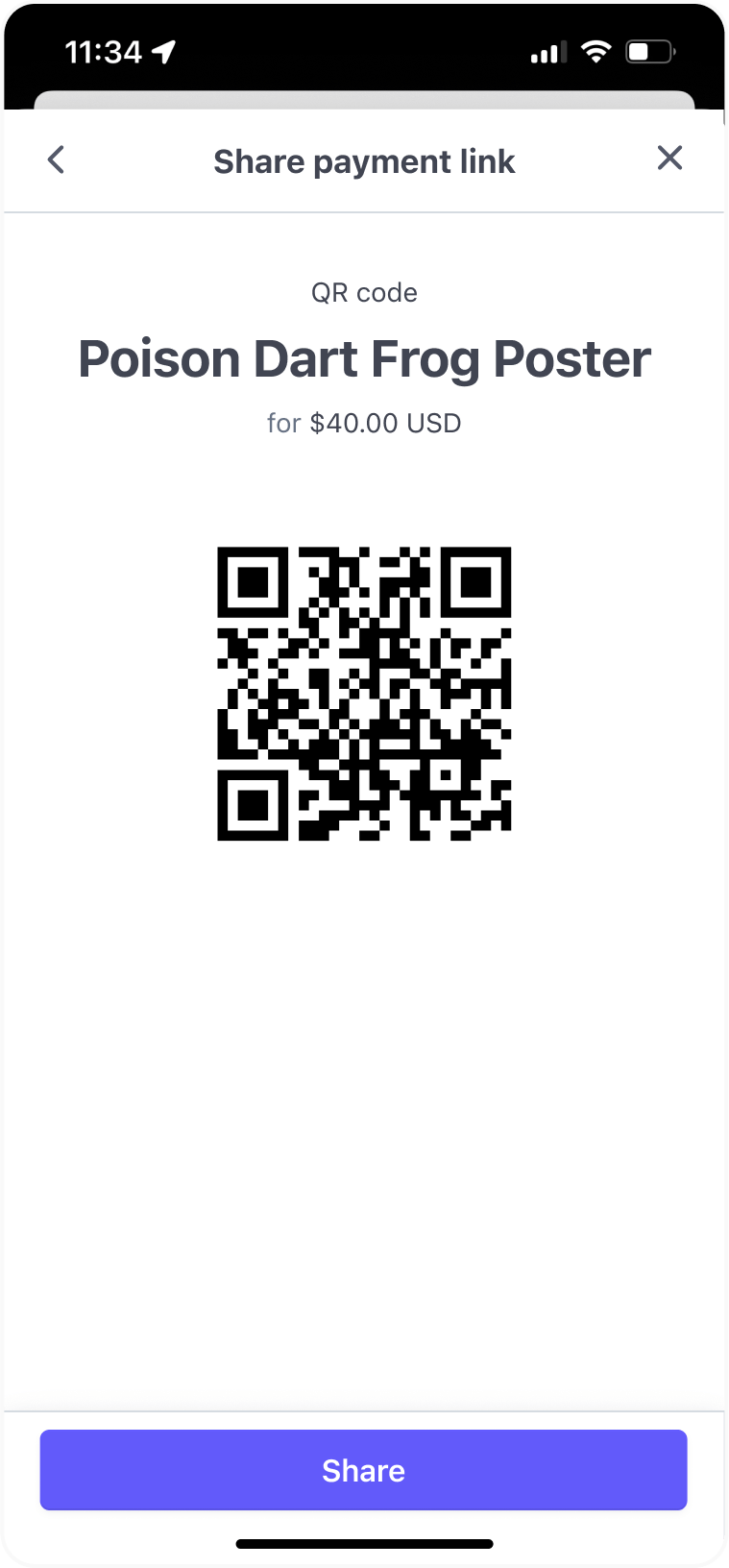

Because the merchant was using their phone in these contexts, and likely interacting with customers face-to-face, we could take advantage of QR codes and native sharing to make the payment process more seamless. Both of these integrations increased adoption of payment links substantially, making it a clear example of non-zero-sum strategy; instead of canabalizing users, the mobile app created entirely new user segments.

Conclusion

By adding tap-to-pay and payment links to the Stripe app, we supported existing mobile-first merchants and enabled entirely new use cases. The impact was immediate: in the 6 months after launching these features, monthly active users of the app had jumped from 372k to 517k (2×) and payment volume from the mobile app had gone from $32M to $130M (4×). Bringing more features to users through the mobile app is now a proven strategy to grow adoption of Stripe's products.

Join the mailing list

I'll send new posts to your inbox, along with links to related content and a song recommendation or two.